(Bloomberg) — The Chinese economy was supposed to drive a third of global economic growth this year, so the dramatic slowdown in recent months is setting off alarm bells around the world.

Most Read from Bloomberg

Policymakers are bracing for a blow to their economies as China’s imports of everything from building materials to electronics decline. Caterpillar says Chinese demand for machinery used on construction sites is worse than previously thought. US President Joe Biden described the economic problems as a “time bomb”.

Global investors have already withdrawn more than $10 billion from Chinese stock markets, and most of the selling has been in blue-chip stocks. Goldman Sachs and Morgan Stanley cut their targets for Chinese stocks, with the former also warning of the risks of spillover to the rest of the region.

Asian economies are taking the biggest hit to their trade by far, along with countries in Africa. Japan reported its first drop in exports in more than two years in July after China cut purchases of cars and chips. Central bankers in South Korea and Thailand last week cited the weak recovery in China to lower their growth forecasts.

However, it is not all doom and gloom. China’s slowdown will drive down global oil prices, and deflation in the country means lower prices for goods shipped around the world. This is useful for countries such as the United States and the United Kingdom that are still suffering from high rates of inflation.

Some emerging markets such as India also see opportunities, hoping to attract foreign investment that might leave China’s shores.

But, as the world’s second-largest economy, a prolonged slowdown in China would hurt rather than help the rest of the world. An analysis by the International Monetary Fund shows the extent of the risks at stake: when China’s growth rate rises by 1 percentage point, global expansion is boosted by about 0.3 percentage points.

Peter Berezin, chief global strategist at BCA Research Inc., said in an interview with Bloomberg Television that the downturn in China is “not a bad thing” for the global economy. “But if the rest of the world, the US and Europe, slips into recession, if China remains weak, that will be a problem – not just for China, but for the entire global economy.”

Here is a look at how the slowdown in China has spread across economies and financial markets.

Trade stagnated

Many countries, especially those in Asia, consider China their largest export market for everything from electronic parts and food to metals and energy.

The value of Chinese imports has fallen for nine of the past 10 months as demand has fallen from record levels set during the pandemic. The value of shipments from Africa, Asia and North America was lower in July than it was a year ago.

Africa and Asia were the hardest hit, with the value of imports declining by more than 14% in the first seven months of this year. This is partly due to lower demand for electronic parts from South Korea and Taiwan, while lower commodity prices such as fossil fuels are also affecting the value of goods shipped to China.

Read more: Stalling growth in China threatens to hamper demand for commodities

So far, the actual volume of commodities such as iron ore or copper sent to China has remained constant. But if the slowdown continues, shipments could be affected, which will affect miners in Australia, South America and elsewhere around the world.

contraction pressure

Producer prices in China have contracted over the past 10 months, which means the cost of goods shipped out of the country is lower. This is welcome news for people around the world who continue to suffer from high rates of inflation.

Prices of Chinese goods on US sidewalks have fallen every month this year, and that is likely to continue until factory prices in China return to positive territory. Economists at Wells Fargo & Co. estimate that a “hard landing” in China – which they define as a deviation of 12.5% from its growth trend – would lower the baseline forecast for US consumer inflation in 2025 by 0.7 percentage points, to 1.4. %.

Slow tourism recovery

Chinese consumers spend more on services, such as travel and tourism, than on goods, but have not yet ventured abroad in significant numbers. Until recently, the government banned group trips to many countries, and there remains a shortage of flights, which means travel is much more expensive than it was before the pandemic.

Read more: China is open to travel but few tourists come or go

The pandemic and a weak economy have slashed incomes in China, while a years-old housing market slump means homeowners feel less affluent than before. That suggests it may take a long time for overseas travel to rebound to pre-pandemic levels, hitting countries that depend on tourism in Southeast Asia such as Thailand.

currency effect

China’s economic woes have pushed the currency down more than 5% against the dollar this year, with the yuan close to breaking 7.3 yuan this month. The central bank has stepped up its defense of the yuan through various measures including the daily peg.

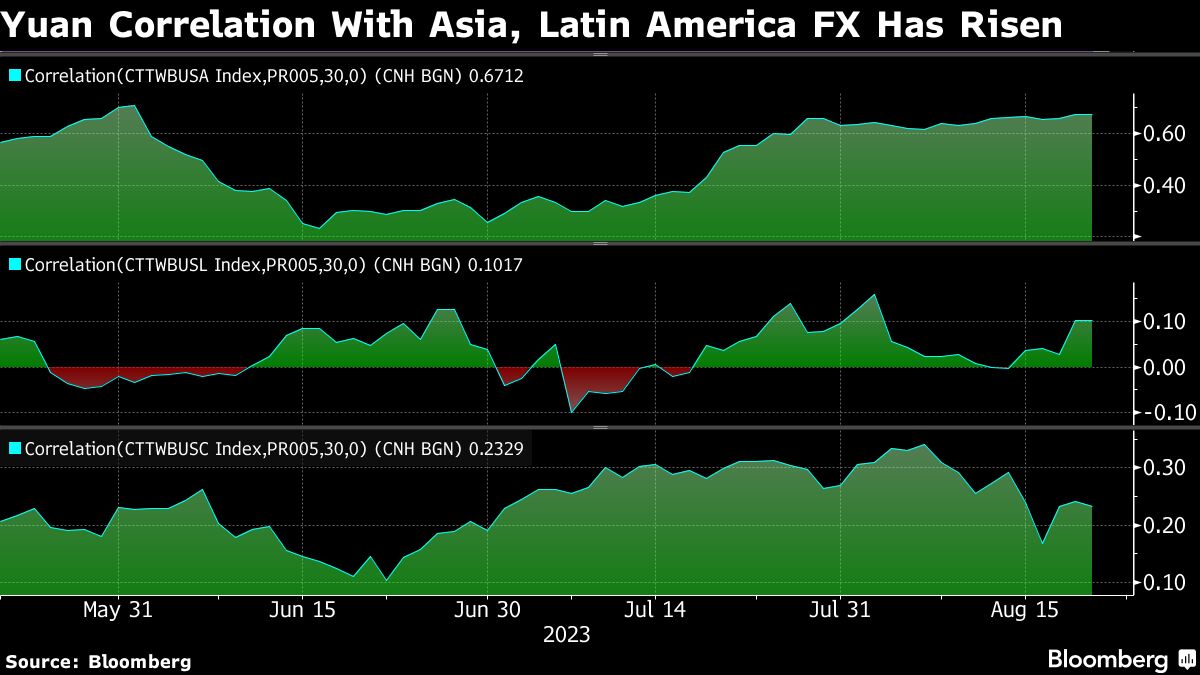

Bloomberg data shows that the depreciation of the offshore yuan is having a greater impact on its counterparts in Asia, Latin America and the Central and Eastern European bloc, with the Chinese currency’s peg to some other currencies rising.

The impact of the weak sentiment could affect currencies such as the Singapore dollar, Thai baht and Mexican peso with higher correlations, according to Barclays.

“With the weakness of the Chinese economy, it is very difficult to be optimistic about Asian economies and currencies, and we are more concerned about currencies that are exposed to metals,” said Magdalena Polan, head of emerging markets macroeconomic research at PGIM Ltd. She said the sector could see the currencies of commodity-dependent economies, such as the Chilean peso and the South African rand, suffer.

The Australian dollar, which is often traded as an alternative to China, lost more than 3% this quarter, the worst performer in the G10 basket.

Bonds lose appeal

China’s rate cuts this year have made its bonds less attractive to foreign investors, who have reduced their exposure to the market and are looking for alternatives in the rest of the region.

Overseas holdings of Chinese sovereign securities are at the lowest share of the total market since 2019, according to Bloomberg calculations. Global funds turned more bullish on the local currency bonds of South Korea and Indonesia as their central banks neared the end of their rate hike cycles.

luxury stocks

Companies from Nike to Caterpillar reported that the slowdown in China had hit their earnings. The MSCI index that tracks global companies with the largest exposure to China fell 9.3% this month, nearly twice the decline in the broader measure of global equities.

Read more: Global equity managers on standby as China pain spreads

A measure of European luxury goods and Thailand’s travel and leisure also tracks losses in China’s onshore stock index. Redmond Wong, market strategist at Saxo Capital Markets in Hong Kong, said the sectors are “accurate reflections of how global investors are indirectly exposed to China and the outlook as the Chinese economy continues to take its toll.”

Luxury goods firms such as Louis Vuitton bag maker LVMH, Gucci owner Kering SA and Hermes International are particularly vulnerable to any fluctuation in Chinese demand.

— with assistance from Marcus Wong and Ernest Tsang.

Most Read from Bloomberg Businessweek

©2023 Bloomberg LP