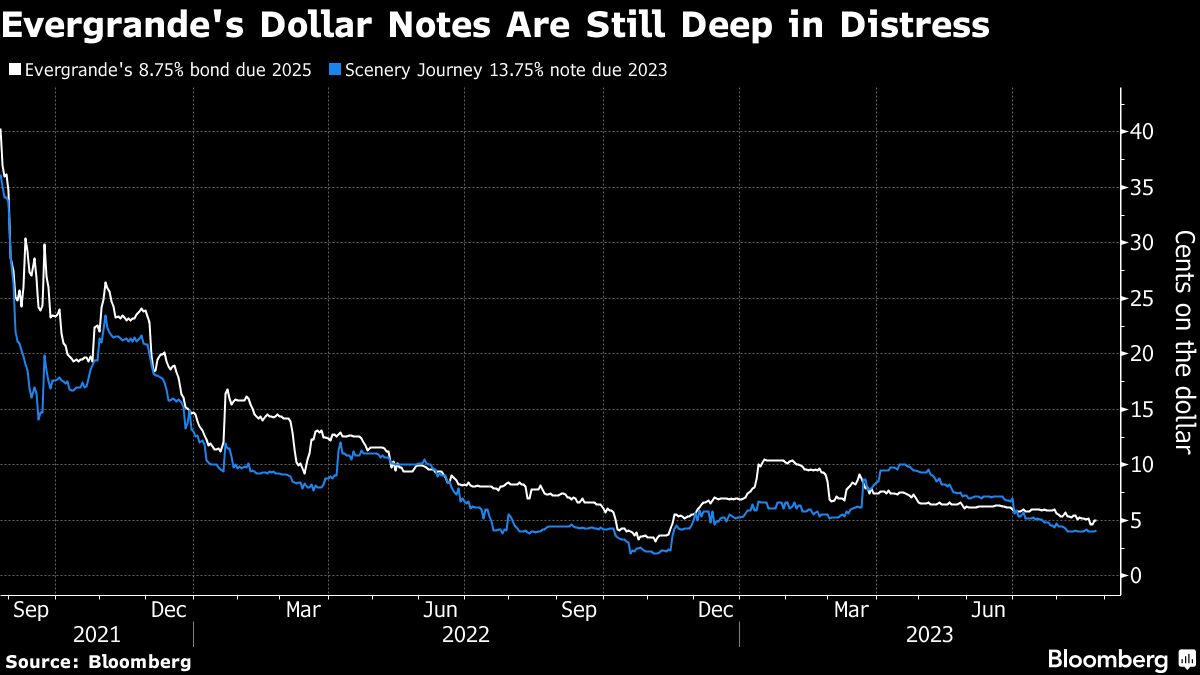

(Bloomberg) — China Evergrande Group has postponed major votes on its foreign debt restructuring plan just hours ahead of schedule Monday, adding uncertainty to a drawn-out process to finalize one of the country’s largest-ever restructurings.

Most Read from Bloomberg

The ailing developer, at the center of a real estate crisis that has unleashed record delinquencies in a threat to Chinese financial markets, said it had delayed group meetings and some units until Sept. 25-26.

Evergrande has indicated its desire to allow creditors to assess recent developments including the resumption of trading in its shares, as well as the terms of the proposals. And its shares fell by as much as 87% in Hong Kong trading after a 17-month hiatus, to become a penny share.

“It is possible that the lack of sufficient votes is the reason behind the delay,” said Ting Ming, chief credit strategist at Australia and New Zealand Banking Group, adding that it was uncertain whether the meeting would be pushed back further at a later date. She said that while the resumption of share trading helps creditors gauge value as they think about how to vote, it is likely that the sharp drop in share price has raised more concerns for them.

Investors’ patience is running out. Evergrande beat previous targets when it unveiled its restructuring plan, and global money managers are still seeking clarity on what they might recover some 20 months after the company’s first public bond default. Monday’s last-minute change is also the second such abrupt delay by a large, struggling Chinese developer in a few days, after Country Garden Holdings delayed Friday’s vote on its request to extend a domestic bond payment.

Evergrande finally revealed its restructuring plan in March. But in its latest update in April, it said support was still short of a major group of investors known as Series C creditors that account for nearly $15 billion in claims. The company did not provide any further updates on Monday about the level of support it had gathered.

The creditors were scheduled to meet on Monday evening, Beijing time, at the law firms of Sedley Austin LLP in Hong Kong and Maples & Calder in the British Virgin Islands to vote on the defaulter’s external debt restructuring plan.

The company reported a loss attributable to shareholders of 33 billion yuan ($4.5 billion) for the six months ended June 30, according to a filing on the Hong Kong Stock Exchange on Sunday.

Monday’s delay wasn’t the first time Evergrande has rescheduled creditor meetings. It obtained court approval to hold votes on its foreign debt restructuring plan in July, and so-called plan meetings were scheduled for last week.

Gatherings had previously been delayed by several days, which the builder said was intended to give creditors time to consider the implications of a share sale by the developer’s electric vehicle unit. Depending on the March roadmap, Evergrande’s creditors could get a new bond maturing in 10 to 12 years or a combination of new debt and instruments linked to the stock of the automaker, the developer’s real estate services unit or the construction company itself.

Evergrande recently filed for Chapter 15 bankruptcy protection in New York, a move that if granted would protect it from creditors in the US while it works on a restructuring deal elsewhere.

Evergrande disclosed in April that more than 77% of its Series A creditors, which account for $17 billion in claims and include a dedicated group of bondholders, have joined the restructuring support agreement. The figure among Series C creditors, which includes margin loans and repurchase commitments, was “more than 30%”. This is less than the 75% required of each creditor group to implement the restructuring through arrangement plans.

At a court hearing in July, an Evergrande attorney said the developer had prepared new information for creditors, including a recovery analysis conducted by Deloitte. He added that the average recovery for Evergrande bonds would be 22.5%, compared to 3.4% if the company was liquidated.

–With assistance from Emma Dong, Dorothy Ma, and Alice Huang.

(Updates with more background all the time.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg LP