(Bloomberg) — Weary U.S. Treasury bonds have proven irresistible to some investors even after Federal Reserve Chairman Jerome Powell said he was willing to raise interest rates again to stifle inflation.

Most Read from Bloomberg

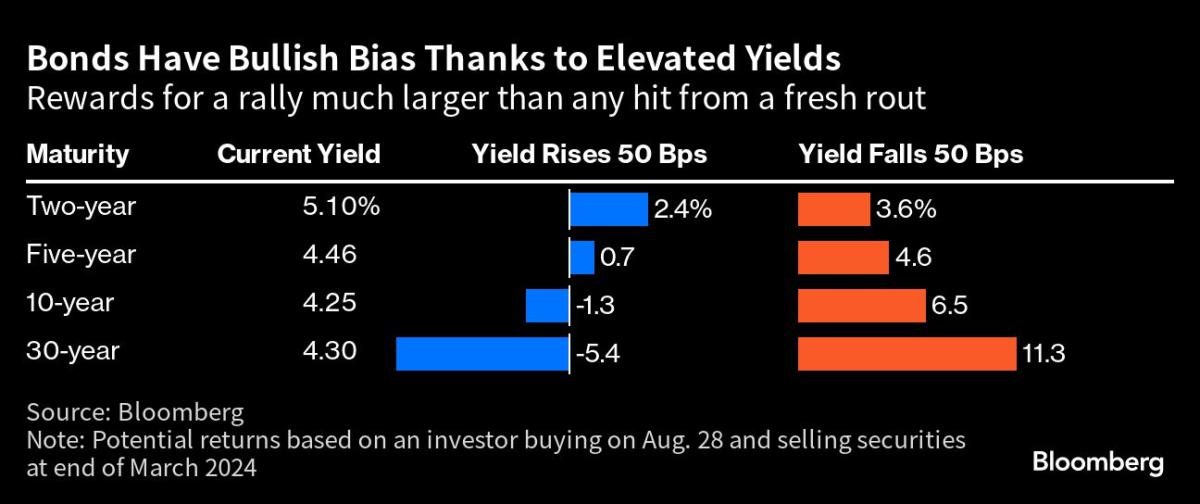

Western Asset Management says the bond is set to outperform due to attractive yields, while JPMorgan Chase & Co. He bets bullish on fixed income despite Powell’s warning at Jackson Hole on Friday. The bulls argue that even the Fed’s new hikes won’t lead to bond losses steep enough to outpace income from the highest yields since 2007.

“There may be significant value in the bond market at current yields,” John Bellows, fund manager at Western Asset in Pasadena, California, wrote in a note to clients. “A further decline in the inflation rate will eventually allow the Fed to return real interest rates to more normal levels.”

In early US trading on Monday, Treasury yields were in a broad-based decline led by the 10-year note, falling more than three basis points on the day at around 4.20%.

The yield on 10-year bonds reached a 16-year high last week, as markets became less optimistic about the Fed’s potential pivot to rate cuts. Speaking in Jackson Hole, Powell acknowledged that inflation has slowed thanks to the tightening of monetary policy but warned that the process “still has a long way to go”.

Treasury bonds gave investors a 1.3% loss during the first four weeks of August, heading for a fourth month of declines, according to the Bloomberg Index.

Treasury yields at current levels suggest the worst of the rout may have happened, according to money manager James Wilson at Jamieson Coote Bonds Pty in Melbourne.

“We are very confident that we are close to the revenue peak,” he added. “Interest rates are at constrained levels, but the lagging effects of monetary policy mean that it is difficult to know when, and to what extent, interest rates will slow growth.”

JPMorgan is also bullish.

“With yields near session highs, valuations somewhat cheap, and next week’s data likely to show further easing in labor markets, we remain long positions,” the strategists, including Jay Barry, wrote in a note published on Friday. tactical 5-year Treasury bonds.

Several other Wall Street banks are recommending clients to add treasuries, at least tactically, after last week’s move towards higher yields. For example, strategists at Goldman Sachs said that positioning indicators indicate that “real money investors may find current real return levels attractive enough and are likely to add duration”, a trend that could continue beyond this week.

Two Treasury auctions on Monday — a new two-year note at 11:30 a.m. New York time and a new five-year note at 1 p.m. — will gauge investors’ appetite for higher yield levels. Based on pre-auction trading, auctions were on the verge of the highest returns since 2006 and 2007, respectively.

bearish funds

Not everyone views Treasuries as a buy.

Hedge funds ramped up their bets on Treasury bonds a few days before the Jackson Hole Symposium. They added net short positions across the curve from two-year futures contracts to long-term securities, according to data from the Commodity Futures Trading Commission.

Some of these positions may be related to what is known as fundamental trading – a strategy that seeks to take advantage of the price differences between cash Treasuries and the corresponding futures contract.

What Bloomberg Strategists Say…

Nor has Powell gone out of his way to rule out rate cuts. Ultimately, he suggested, the Fed can proceed “carefully” – a management style he shares with one of his most famous predecessors, Alan Greenspan.

Anna Wong, chief US economist

Click here for the full analysis

Kelly Wood, fund manager at Schroders in Sydney, said investors “need a clearer path for interest rates”. “We have been cautious about adding to interest rates here on the view that cuts remain unpriceable in a higher long-term environment, which could result in underperformance for the Five and Tens.”

While hedge funds have increased their bearish positions, real money investors are betting on a rebound in Treasury bonds. CFTC data also showed that asset managers added to their net long positions in 10-year Treasury futures in the week ended Aug. 22.

“Investors have wanted an opportunity for compelling returns since 2008,” said Gautam Khanna, money manager at Insight Investments in New York, ahead of the Jackson Hole event. “So they should seriously consider seizing this opportunity to increase provisions for medium- and long-term US fixed-income assets.”

–With assistance from Matthew Burgess, James Heray, Yi Shih, and Joanna Osinger.

(Adds strategists’ views in paragraph 11, auctions in paragraph 12, and updated return levels.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg LP