Personal finance expert Dave Ramsey has raised concerns about the growing popularity of adjustable rate mortgages (ARMS). On a recent episode of “The Ramsey Show,” Ramsey didn’t hold back from calling ARMs “a ticket to foreclosure” rather than a path to home ownership.

In the episode, co-host George Kamel asked a “passive aggressive” question posted on Experian regarding whether adjustable rate mortgages can help people buy homes. Ramzy explained that he saw a sinister motive behind the question. He has questioned the vested interests of organizations like Experian in promoting ARM, implying that their goal is to get people into debt and keep them there. When people take out mortgages, their credit scores are checked and monitored, and Experian – one of the major credit reporting agencies – takes advantage of this activity.

Ramsey scoffs at the idea of buying ARM when interest rates are rising. He poses a rhetorical question – “If you buy an adaptive mortgage, in an environment of increasing interest rates, what do you expect it to adjust to? Up. Well, that’s dumber than a rock on the roof.”

do not miss:

according to reconnaissance, 40% of Americans said they would take out an adjustable-rate mortgage. Despite its apparent appeal to some desperate buyers, Ramsey has strong reservations about ARM, and his concerns are not without merit.

He explains that ARMs include a “bait and switch” mechanism. When borrowers start their ARM, they are assigned an index that already carries a higher rate than they can secure with a fixed-rate mortgage at that time. In order for your ARM rate to remain stable during renewal, the broader interest rates must fall, which is often rare.

ARMs can adjust upward quickly when benchmark interest rates rise but move much more slowly when the Federal Reserve announces rate cuts. This dynamic makes it almost certain that your adjustable rate mortgage will go up during the first renovation, which can strain your finances.

Ramsey was emphatic in his assessment, noting that risk management tools are among the most important financial traps ever devised. If the Fed continues to raise interest rates, as it has in recent history, ARM could quickly become unsustainable. Homeowners who default on payments risk default on their mortgage and, ultimately, foreclosure.

Much of Ramsay’s skepticism about ARMs is based on his experience in the real estate industry, especially during the 1980s. This period saw interest rates soar, with rates reaching a staggering 17%. This situation led to a banking crisis, as many financial institutions found themselves paying high interest rates to depositors while receiving lower payments from borrowers locked into fixed-rate mortgages.

This turbulent period, which is often referred to as savings and loan crisis, This led to the bankruptcy of many lenders. To mitigate this risk, banks introduced adjustable-rate mortgages, which effectively shifted risk from the lender to the borrower.

Ramzy asserts that this shift had little to do with helping potential homebuyers, but only with the banks protecting their interests. He argues that banks have a long history of prioritizing their own financial well-being over that of their borrowers.

read the following:

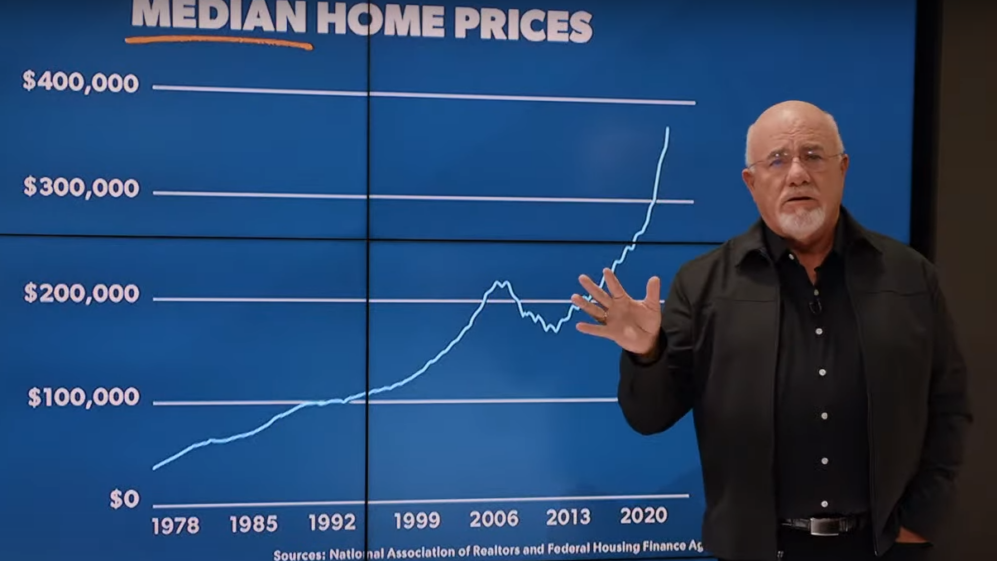

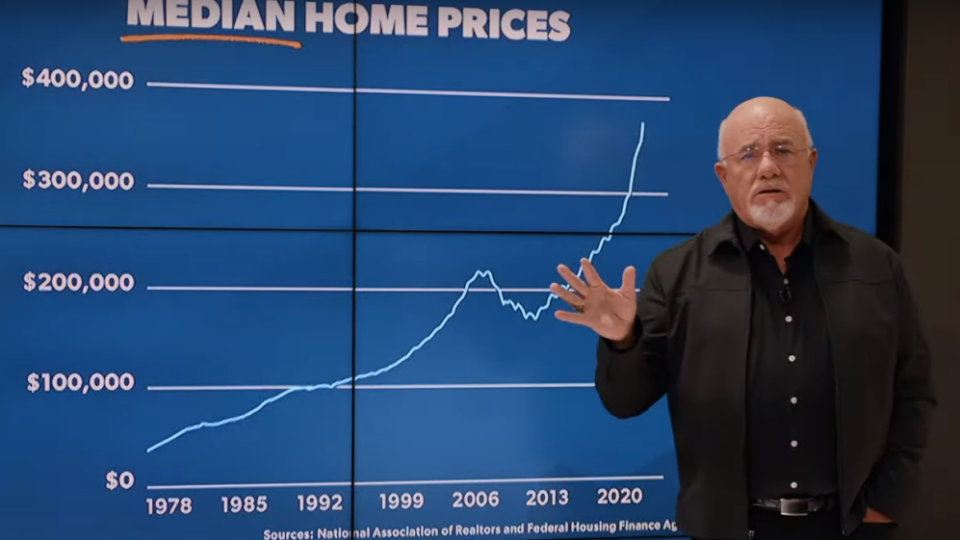

Image source: screenshot from Is the housing market going to crash? | Ramsey real estate reality check on YouTube.

Don’t miss out on real-time alerts on your stocks – join Benzinga Pro Free! Try the tool that will help you invest smarter, faster and better.

This article “A Ticket to Foreclosure” Dave Ramsey Warns of This Mortgage Trap, Calls It “Dumper Than a Rock on the Roof” originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.