After a losing streak in 2022, video game stocks posted steady gains throughout 2023. Despite their higher prices, some of the larger, higher-quality gaming stocks are still trading at attractive prices. These include some of the biggest names in the industry, such as Nintendo NTDOY and Roblox RBLX.

To search for undervalued gaming stocks, we turned toMorningstar Global Electronic Games and Multimedia Indexwhich tracks companies that develop or publish video games and other multimedia software applications, including for personal computers, consoles, mobile phones, tablets, and other portable media players.

At the start of 2022, video game stocks saw strong returns stemming from the COVID-19 pandemic. During 2020 and 2021, many people found themselves with extra time on their fingertips and were looking for distractions, which led to an increased interest in gaming. But this interest did not last for those who invest in video game stocks. As the world opened up throughout 2022, gaming stocks lost value as people had less free time.

As of August 8, 2023, the video game index is up just 3.9% for the subsequent twelve-month period, while the broader stock market is up 9.8% as measured by it.US Morningstar Market Index. For the 2023 calendar year, the video game index is up 11.9% while the broader market is up 18.1%.

Gaming stocks are undervalued

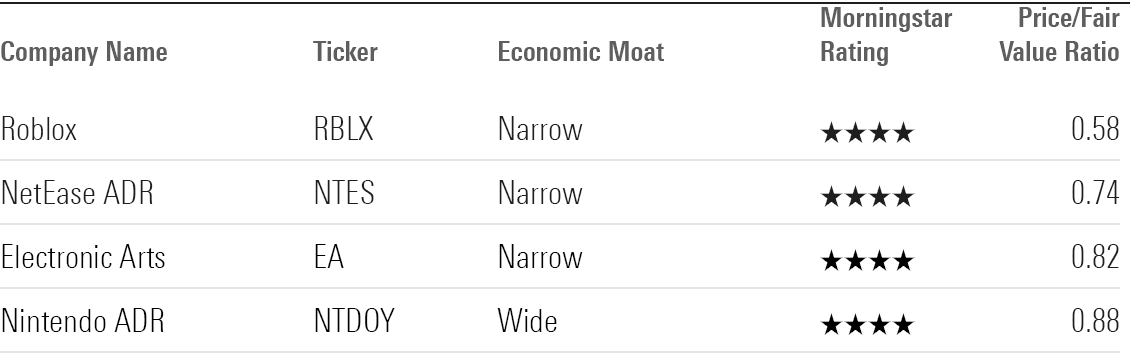

We looked for the most undervalued stocks in the game index by examining stocks that currently have a 4- or 5-star Morningstar rating. We also looked for stocks with Morningstar Economic Moat ratings, meaning they have lasting competitive advantages that are expected to last for at least 10-20 years. Historically, stocks with ditches and low valuations tend to outperform over the long term. Of the 57 stocks in this index, only nine are covered by Morningstar analysts, and of those, four are undervalued as of August 8, 2023.

- Roblox

- NetEase NTES

- Electronic Arts EA

- Nintendo

The most undervalued stock is Roblox, trading at a 42% discount to Morningstar’s fair value estimate. The least undervalued is Nintendo’s, trading at a 12% discount. NetEase and Nintendo are based outside of the United States, but US investors can purchase shares as American Depositary Receipts.

Roblox

- Fair value estimate: $60.00

Roblox operates an online video game platform that allows players to create, develop, and monetize games for other players. The company offers developers a combination of a game engine, publishing and hosting platform, online services, a marketplace with payment processing, and a social network. Unlike a full-price AAA title, there is no entry cost to try out Roblox or the vast majority of user-developed games.Thus, to drive booking growth and keep the Roblox model churning, the new user must buy and spend Robux, the platform’s bid.

Roblox benefited greatly from stay-at-home restrictions at the start of the pandemic with absolutely impressive profit growth, even more than its peers. It expanded its user base from 19.1 million daily active users, or DAUs, in the fourth quarter of 2019 to 65 million in the quarter. The second is from 2023. We expect that the combination of popular games and a large user base will attract more users. In addition, we expect the company to be able to increase its penetration in non-US markets. As a result, we believe that growth will be slower than during the epidemic, But that will exceed 108 million units in 2027.

In the long term, we assume that the company continues to invest in adding new features to keep teen developers and gamers engaged with the Roblox platform. While an overall metaverse may be a long way off, we believe Roblox’s steps toward the metaverse will help the platform stick with users and developers as they go. in age.”

—Neil Macker, senior equity analyst

NetEase ADR

- Fair value estimate: $146.00

NetEase, which started as an online portal service in 1997, is a leading online service provider in China. Its main services include online/mobile games, cloud music, media, advertising, email, live broadcast, online education, and e-commerce. The company develops It operates some of the most popular PC and mobile game clients in China, and it partners with leading global game developers such as Blizzard and Mojang (a subsidiary of Microsoft MSFT).

NetEase is now the second largest mobile game company in the world. The company owns one of the most popular multiplayer franchises in China, Imaginary Journey West. Over the past decade, NetEase has taken advantage of the industry’s shift towards mobile and is now focusing on a mobile-first approach to developing innovative, high-quality, long-cycle games.

“For the foreseeable future, we expect NetEase to continue to leverage its in-house R&D team and user data to develop next-generation games. Like its global peers, NetEase maintains a high level of profitability for its gaming business thanks to stable revenue from core titles and the continuous development of new franchises. We believe That the company is in a position to not only capitalize on its success Journey west titles but also continues to diversify its revenue into new franchises.”

—Evan Su, senior equity analyst

Electronic Arts

- Fair value estimate: $150.00

Electronic Arts is one of the largest third-party video game publishers in the world. It owns some of the most popular game franchises, including FIFAAnd MaddenAnd battlefield. We believe the company will strengthen its leading position by developing compelling new versions of its existing franchises, and creating new releases such as apex legends, And the acquisition of well-established enterprises such as F1 From Code Masters. We expect EA to continue to benefit from the growing availability of current-generation consoles, the continued revitalization of PC games, and growth in the mobile gaming space.

Like its peers, EA has benefited from a shift within the industry towards a divided market consisting of massive AAA titles on one side and smaller indie games on the other. EA’s primary competition remains from other major publishers, such as Tencent, Take-Two, and Activision, as well as publishers of “First party Sony SONY, Nintendo and Microsoft. EA is also a large publisher on mobile platforms. We expect the company to continue to use its portfolio of franchises and licenses to create new games, particularly in the free-to-play space.”

—Neil Macker, senior equity analyst

Nintendo ADR

- Fair value estimate: $12.52

“Nintendo has been in the gaming business for 40 years, and we believe the franchises it has created throughout its history, including Super Mario Bros., Pokemon, The Legend of Zelda, Mario KartAnd animal crossing, will help the company to achieve increased returns in the long run. Over the past decade, Nintendo has focused on effectively leveraging its characters on nongaming platforms to increase user touch points, which we believe has successfully built its brand strength. Nintendo’s sales in the June quarter and its operating income, reported on August 3, reached historic highs due to the contribution of Super Mario Bros movie and strong first-party game sales, even though the Switch console is nearing the end of its life cycle. We view this strong performance as evidence that Nintendo’s strategy is working. We believe its shares are undervalued.

“We believe Nintendo’s fans will increase as people are able to enjoy its characters across various media, and the success of the Switch proves that the company is able to attract new fans by leveraging its characters and setting up an engaging gameplay path. Future challenges include monetizing its characters efficiently in its underdeveloped business.” It’s console-based, its return to the larger China market, and adapting to the proliferation of cloud gaming. However, we believe the company’s ability to deliver fun games remains intact.”

—Kazunori Ito, director