by Wayne Cole

SYDNEY (Reuters) – Asian markets tumbled on Monday after China cut lending rates even lower than markets had been counting on, continuing disappointing stimulus steps by Beijing.

China’s central bank cut its one-year lending rate by 10 basis points and left the five-year interest rate unchanged, a surprise to analysts who had expected cuts of 15 basis points for both.

Disappointment with the meager move sent Chinese blue chips down 0.3%, while the Australian dollar weakened as a liquid proxy for Chinese risks.

Investors had hoped to repeat the massive fiscal spending that affected the economy in the past, but Beijing appears reluctant to add borrowing tasks.

MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.3% to a new low for the year, adding to a 3.9% drop last week.

Japan’s Nikkei is still up 0.3%, although that followed a 3.2% drop last week.

EUROSTOXX 50 futures and FTSE futures were close to flat. S&P 500 futures were flatter, up 0.1%, while Nasdaq futures were up 0.2%. AI-darling Nvidia’s earnings on Wednesday will be a major valuations test.

Analysts worry that the market has gone on too long, especially in technology, leaving it vulnerable to a deeper downturn.

The latest Bank of America survey of fund managers found that sentiment was the least declining since February 2022, while liquidity levels were at their lowest level in nearly two years, and 3 out of 4 respondents expect little or no downturn in the global economy.

Meanwhile, analysts at Goldman Sachs argue there is still room for investors to add to equity positions.

“Reopening the buyback blackout window will provide a boost to equity demand in the coming weeks, although a wave of expected equity issuances this fall may provide partial compensation,” they wrote in a note.

Chopping Powell

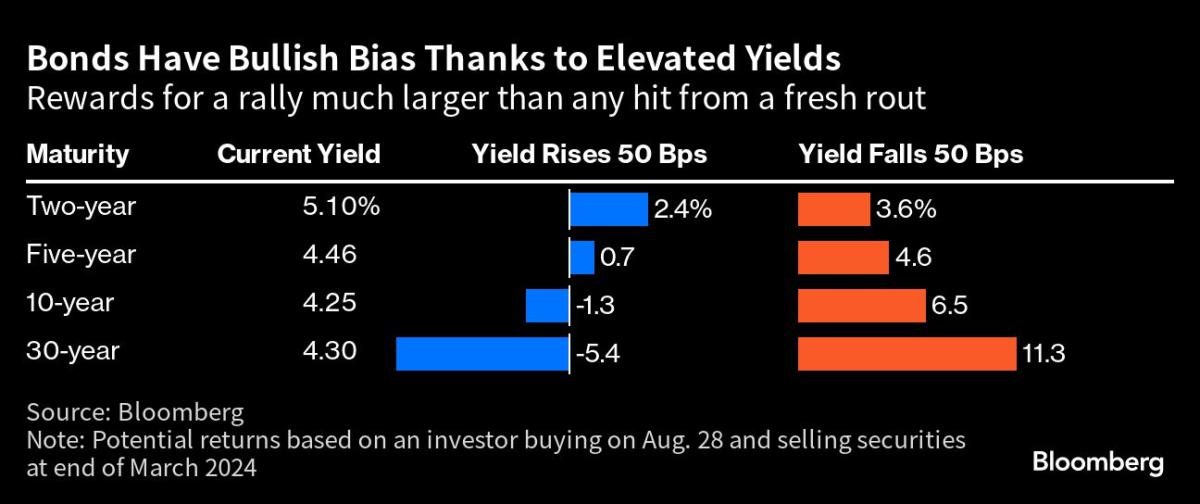

Equity valuations were pressured in part by a sharp rise in bond yields, with the US 10-year hitting a 10-month high last week at 4.328%.

Early Monday, yields rose again at 4.28% and a break above 4.338% would take them to levels not seen since 2007.

Markets assume that Federal Reserve Chairman Jerome Powell will notice the jump in yields at this week’s Jackson Hole conference, as well as the strong economic data released recently. The Atlanta Fed’s GDP tracker is now running at 5.8% for the quarter.

“It’s an opportunity for Powell to provide an updated assessment of economic conditions, which now look stronger than expected and strengthen the case for additional rate hikes,” said Barclays analyst Marc Giannone.

“Though, we would be surprised if he provided specific guidance, with the key August releases of employment, CPI and retail sales all coming before the September meeting.”

A majority of analysts surveyed think the Fed is done hiking, while futures point to a 31% chance of another hike by December.

The rally in yields helped the greenback post a five-week gain and a nine-month peak for the Japanese yen at 146.56. On Monday, it was trading at 145.30 with the market worried about the risks of Japanese intervention. (American dollar/)

The euro also settled at 157.96 yen, but was pressured by the dollar at $1.0871 after losing 0.7% last week.

The rise of the dollar and yields was pressuring gold at $1,887 an ounce, after it touched a five-month low last week. (joule/)

Oil prices rose on Monday, snapping a seven-week winning streak as concerns about Chinese demand offset supply shortages. (or)

Brent crude rose 38 cents to $85.18 a barrel, while US crude jumped 45 cents to $81.70 a barrel.

LNG prices were supported by the risk of a strike at Australian offshore facilities that could affect around 10% of global supply.

(Reporting by Wayne Cole; Editing by Shri Navaratnam)