The markets have been showing some choppy trends lately, as the strong rally seen in the first half of the year seems to have withered a bit under the summer sun.

However, fear does not appear to be the advice of a prominent stock picker. With U.S. inflation dropping to 3% recently from 9% last summer, and with fourth-quarter GDP growing at 2.4%, celebrity investor Bill Miller, with an estimated net worth of $1.4 billion, thinks about the rest of the year. Looks good for the stock market.

“It’s entirely possible that we could get back to 2% inflation by the end of this year,” says Miller. “If we do that without going into recession and earnings are OK, that will give you a much higher justified valuation in the market than we are at right now.”

With such a positive outlook, it makes sense to see which stocks Miller believes will continue to deliver the goods. In this regard, we took a closer look at two distributed shares, offering yields of up to 9%, which is currently owned by Miller’s company, Miller Value Partners. This is what we found.

real estate growth CTO (CTO)

We’ll start with CTO Realty Growth, a real estate investment trust (REIT) focused on shopping malls and retail real estate. The company’s portfolio features assets in the southeastern and southwestern United States, and relies heavily on high-quality, income-producing real estate. The CTO also owns a significant stake in Alpine Income Property Trust, another retail-oriented REIT.

CTOs do not select their real estate investments simply because of their current income generation potential; The company is also focused on potential future income. More than half of its investment portfolio investments – 13 out of 21 properties – are located in Florida, Georgia or Texas, three of the fastest-growing US state economies. By GDP growth, all three states rank in the top ten.

Continuing the momentum we saw during the first quarter, the company delivered a solid set of results in the second quarter. The cap came in at $26.05 million, up 34% year-over-year and beating expectations of about $1.82 million. The company’s net profit number, which is net income per diluted share of 3 cents, compared favorably to last year’s 0-EPS quarter — and it was 11 cents per share better than expected.

Of particular interest to dividend investors, the CTO reported second-quarter funds from operations, or FFO, at 43 cents per diluted share. That was 6 cents better than expected, and covered 38 cents of the dividend entirely. The dividend, last declared in May and paid on June 30, was an increase of 1.8% year-over-year. The annual rate, at $1.52 per common share, gives a yield of 9.2%.

Turning our focus to Miller’s involvement with the CTO, we find that the billionaire’s company owns 436,900 shares worth $7.2 million.

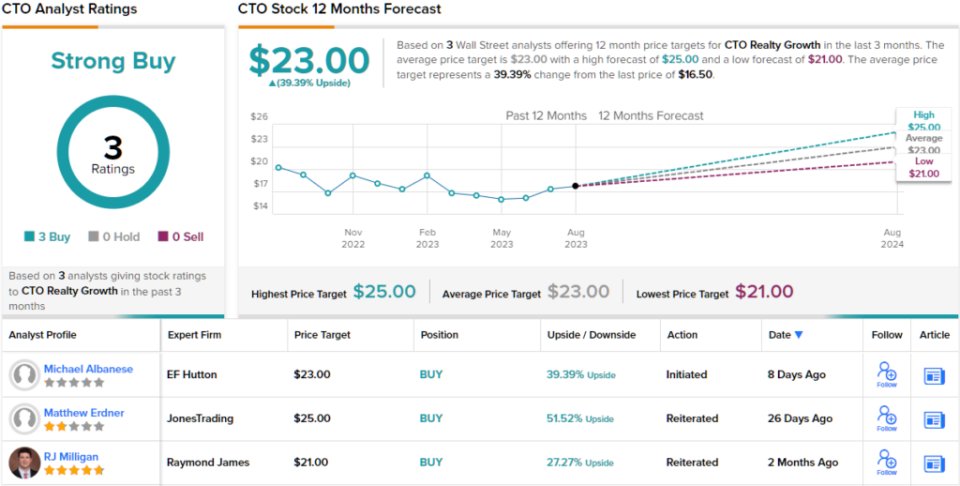

The CTO’s attractive valuation and return potential has also caught the attention of analyst Matthew Erdner, of Jones Research, who writes about the stock: “We remain constructive on the portfolio and believe there is significant upside to current trading levels. CTO shares remain significantly undervalued relative to their peers based on to traditional valuation metrics. The CTO trades at a discount of 29% to our estimate of NAV of $24.95 for the second quarter of ’23 and a dividend yield (9.2%).”

Erdner’s comments support his Buy rating here, and the $25 price target implies a 51% return for the next year. (To watch Erdner’s track record, click here)

Overall, all three recent analyst reviews of the CTO are positive, for a unanimous consensus rating of Strong Buy. An average price target of $23 implies a 39% upside in the stock from its current trading price of $16.5. (be seen CTO stock forecast)

jackson financial (JXN)

For the next stock, we’ll be moving out of REITs and into the realm of long-term financing. Jackson Financial is a holding company, headquartered in Lansing, Michigan, with subsidiaries in life insurance and asset management. The company is best known as a provider of RILAs, or index-linked annuities, and insurance-based, tax-deferred long-term savings options that provide risk-controlled growth options to retail investors.

Jackson’s product lines are based on variable annuities, allowing clients to take advantage of a wide range of investment options. Variable annuities bring higher risks than fixed annuity or index products, including the risk of losing principal, but they also bring the potential for greater long-term rewards. Among the additional benefits Jackson offers with annuities are a diversified asset distribution, guaranteed income for life, and an inheritable option for purchaser’s heirs.

While there are risks in long-term annuity products, these are mitigated by regulatory requirements that stipulate minimum reserves that financial institutions need to hold to cover claims. Jackson has “dragged” his reserves in Virginia, but has engaged in discussions with regulators in his home state of Michigan, aiming, among other things, to increase transparency in the Virginia bloc. This is a viable solution, as the company’s fees are likely to outweigh claims in the long run.

In the near term, looking at Jackson’s Q2 ’23 financial report, the last reported report, we find that the company’s upper and lower earnings are down year-over-year — and below expectations. Revenue, at $410 million, was well below the $6.7 billion reported in the second quarter of 2022 and topped expectations by $1.2 billion. On the bottom line, the non-GAAP EPS number of $3.34 per share came in 15 cents below estimates.

Despite the profit loss, Jackson still returned $100 million in principal to investors during the second quarter. This included $53 million in dividends. In the company’s most recent dividend announcement, issued on Aug. 8 for the third quarter, the payment was set at 62 cents per common share for the Sept. 14 payout. This converts annually to $2.48 and gives a yield of 7.3%, well above the market average.

Bill Miller clearly has an optimistic view when it comes to JXN, as he owns 215,050 shares of the stock. The stake is currently valued at $7.13 million.

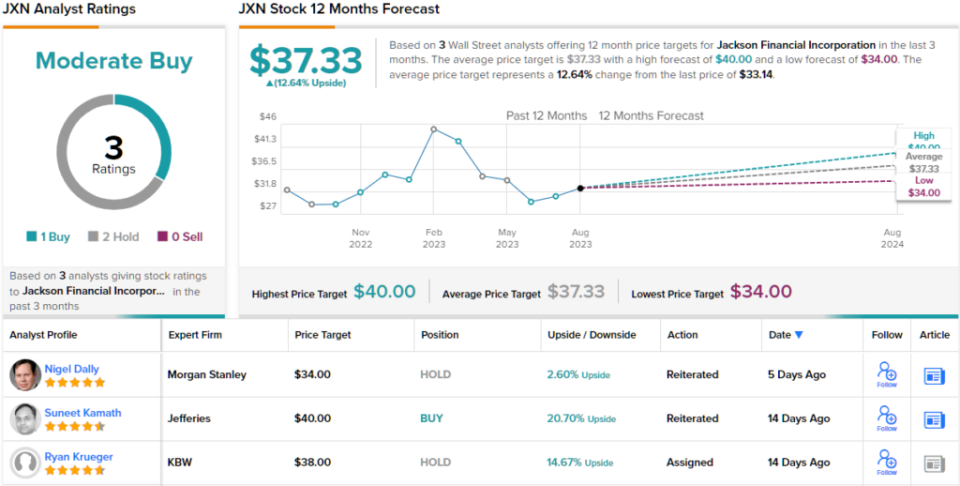

Miller isn’t the only bull here. Jefferies analyst Suneet Kamath noted that the company is likely to successfully solve its “VA book” issues and is currently offering a stable return on capital. He writes of JXN, “Our Buy rating on JXN is due in large part to our view that a high-quality VA book is not adequately reflected in its rating. We are optimistic that Michigan’s solution can rectify this disconnect somewhat. In the meantime, we believe that The stock offers one of the most attractive capital returns in the space…”

Kamath’s Buy rating completes at $40 which indicates an upside potential of approximately 21% in the coming year. (To watch Kamath’s log, click here)

Overall, JXN stock has a Moderate Buy from the analyst consensus, based on 3 recent reviews that include 1 Buy and 2 Hold. The shares are trading for $33.14 and have an average price target of $37.33, a combination that points to an upside of about 13% in the next 12 months. (be seen JXN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.