-

Most predictions of a stock market decline hinge on US consumer weakness.

-

Pessimistic investors point to trillion-dollar credit card debt, upcoming student loan payments, and excess savings being depleted during the pandemic.

-

But the American consumer has a lot of spending power, and that’s great news for the stock market.

$1 trillion in credit card debt The upcoming restart of student loan payments, There are plenty of reasons to worry about the financial health of the American consumer.

And those fears are getting louder and louder as some stock market strategists anticipating the imminent end of the bull market, This is due in part to consumer weakness which is expected to slow spending.

But some perspective is needed, especially amid an intense period of scary headlines involving Record number of credit card debt and the Drain excess savings that were built during the pandemic.

In fact, US consumers still have plenty of power to spend money, grow the economy, and drive the stock market higher. this is the reason.

1. Low debt service ratio

While a trillion dollars in credit card debt sounds like a lot, what really matters is whether consumers can pay that debt back. And they certainly can.

Less than 10% of US households’ disposable income goes toward debt payments, which include mortgages, auto loans, and credit card obligations.

This is below pre-pandemic levels and below the 10%-12% range that was flat for most of the 2000s, when stocks were remarkably strong.

2. Consumer assets dwarf liabilities

While consumer debt is rising, so too is the value of consumer assets – and the two are not really comparable.

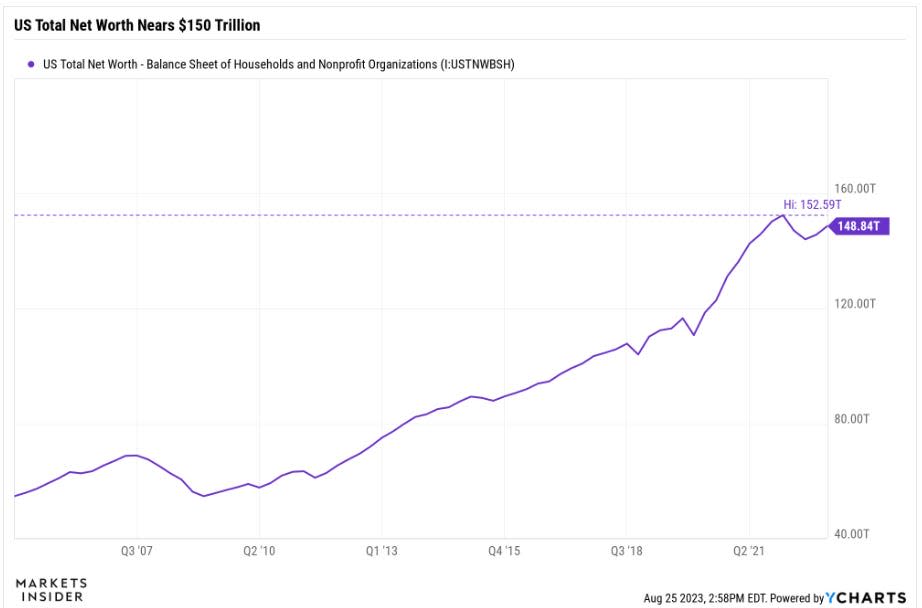

The collective net worth of US consumers is currently just under $150 trillion, and total assets close to $170 trillion, mostly in housing and stocks. On the other hand, total consumer debt is just under $20 trillion, with mortgages accounting for the bulk of that debt.

Consider this: While credit card debt increased by about $100 million from pre-pandemic levels to just over $1 trillion, the total net worth of American consumers increased by about $30 trillion from pre-pandemic levels.

3. Home ownership is an untapped source of money

Homeowners in the United States have accumulated nearly $30 trillion in home equity they haven’t taken advantage of that yet through home equity lines of credit, As shown in the above diagram. Premium home equity lines of credit are nowhere near the peak seen during the 2008 recession.

Utilization rates for home equity lines of credit are 38%, well below the pre-pandemic average of 51%.

Home equity lines of credit are an easy way for homeowners to borrow money against their homes, usually at a lower interest rate than personal loans. The vast sums of money that consumers keep in their homes is optional, allowing them to borrow money in the future. This is a great force that can support more spending and growth for the economy.

4. The average consumer has low mortgage rates

Mortgage rates have risen over the past year to levels that sparked an affordability crisis for new homebuyers, But it’s important to remember that the vast majority of homeowners are locked into their mortgages at historically low rates.

The effective interest rate for outstanding mortgage debt is just 3.60%, just above its lowest level in several decades. And while it may be difficult for new homebuyers given mortgage rates of more than 7%, it may not have as horrific an impact on the economy as some believe.

5. Retail spending is strong with plenty of cash available

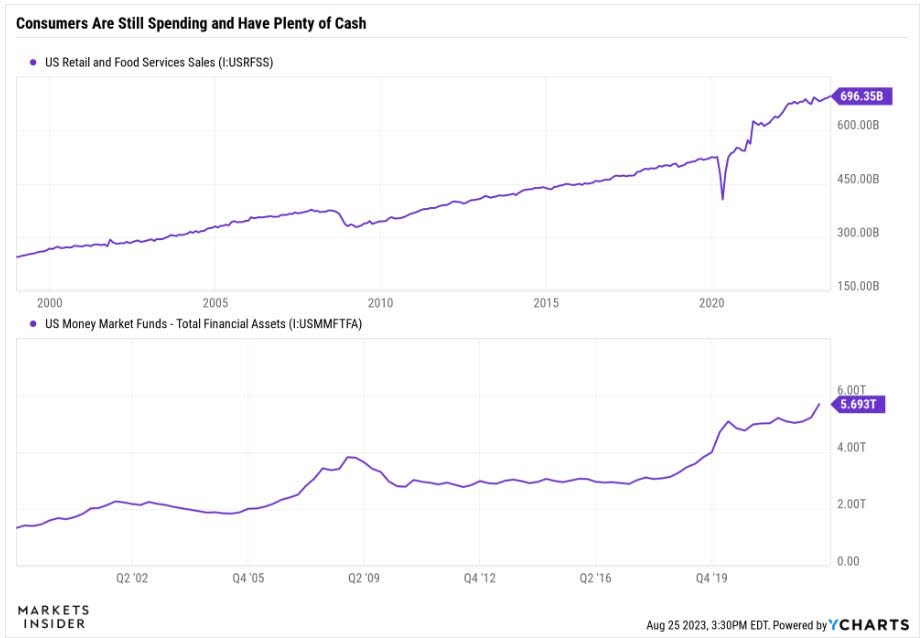

All the hard data shows that the consumer can withstand some hurdles, such as restarting student repayment loans. This is validated by the monthly retail sales data, which showed resilient growth this year. As the consumer continues to spend, their cash pile continues to grow.

Money market funds currently hold nearly $6 trillion in cash, a record high, as investors benefit from risk-free interest rates of 5%. While some of this cash pile is owned by institutions, a large portion is also controlled by consumers.

All in all, American consumers are on a solid footing and have room to continue their spending habits while servicing their debt. And because consumption accounts for about 70% of GDP, this force must continue to flow into the economy and the stock market. So don’t count the consumer yet.

Read the original article at Business interested