-

The first AI trade has already been exposed in the stock market as investors bid on “enablers” like Nvidia.

-

But there’s a second long-term AI trade in the stock market, according to Goldman Sachs.

-

AI trade after trade focuses on companies that should see a massive increase in labor productivity from AI.

There are two stock market deals to be made related to the advent of artificial intelligence technologies, and investors better pay attention, according to a Monday note from Goldman Sachs.

AI has taken over the stock market in 2023, helping save it from a painful bear market And rounding one company to more than $1 trillion Market assessment: nvidia.

Nvidia is an “enabler” of artificial intelligence and is among the first stop in AI stock market trading, where investors bid on companies poised to immediately benefit from the technology.

Other stocks that will see big gains in the near term from artificial intelligence include “super” like cloud computing giants MicrosoftAnd the alphabetAnd Amazonas well as “power users” eg Meta platformsAnd sales forceAnd AdobeAnd service nowAnd gut instinct.

But while enablers, superusers, and enablers represent an early AI trade to hit the stock market, there is a second long-term AI trade that investors can still benefit from, according to the note.

The bank has compiled a basket of “artificial intelligence post-trade” stocks that are expected to see corporate earnings rise from labor productivity gains unlocked through the adoption of AI technologies.

“The AI-driven estimated earnings increase is likely to occur over the next few years, but should be reflected in equity valuations sooner,” Goldman Sachs said. “The broadest and longest-term benefit from AI adoption will accrue to businesses as they harness AI to improve productivity, resulting in increased revenue, increased profit margins, or a combination of both.”

Between 2025 and 2030, Goldman expects AI technologies to take root within companies and have a significant impact on the overall economy as adoption increases.

The bank estimates that the average Russell 1000 stock could see earnings rise by 19% thanks to efficiency gains from AI, while about 8% of Russell 1000 companies would see earnings rise by more than 60%.

Here are the top 10 companies in Goldman Sachs’ AI business second basket.

10. Tenet Healthcare

Pointer: THC

Potential change of earnings from artificial intelligence: 135%

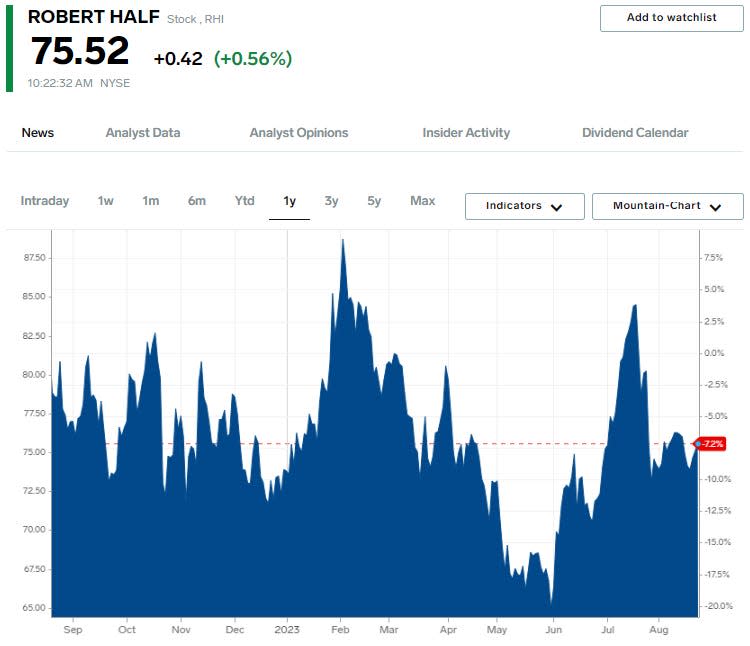

9. Robert Half

Pointer: RHI

Potential change of earnings from artificial intelligence: 150%

8. Snowflake

Pointer: snow

Potential change of earnings from artificial intelligence: 154%

7. Pinterest

Pointer: pins

Potential change of earnings from artificial intelligence: 162%

6. Smartsheet

Pointer: fat

Potential change of earnings from artificial intelligence: 171%

5. Nutanix

Pointer: NTNX

Potential change of earnings from artificial intelligence: 177%

4. MongoDB

Pointer: mdb

Potential change of earnings from artificial intelligence: 193%

3. Trix

Pointer: AYX

Potential change of earnings from artificial intelligence: 203%

2. Clarification

Pointer: clvt

Potential change of earnings from artificial intelligence: 232%

1. Guidewire software

Pointer: wires

Potential change of earnings from artificial intelligence: 388%

Read the original article at Business interested