Sometimes determining the best stocks to buy can be difficult, but you could do a lot worse than checking out stocks handpicked by one of the world’s most experienced hedge fund managers – Warren Buffett.

Buffett’s stock picks are a popular inspiration for investors, and for good reason. His phenomenal stock-picking ability has earned him the nickname “The Oracle of Omaha” and an estimated fortune of $117 billion, making him one of the richest people in the world. And his company, Berkshire Hathaway, is among the most successful, with total assets of more than $1 trillion.

So it’s clear that when Buffett goes shopping, investors are keen to see what’s in the bag. During the second quarter, Buffett opened up new positions in a few homebuilding stocks, and since he’s known for his value investing style, he’d have to think these names are offering just that right now.

But Buffett isn’t alone in liking the look of these particular stocks. Raymond James analyst Buck Horn also identified an opportunity in these stocks, believing they are poised for double-digit growth over the next year.

To get a fuller view of their prospects, we decided to run these pointers through TipRanks database. This is what we found.

Dr. Horton (DHI)

The first stock Buffett bets on is DR Horton, a Texas-based construction company and leader in the homebuilding industry in the United States. The company has held the title of “Nation’s Largest Homebuilder” for more than 20 years and operates in 113 housing markets across 33 states. DR Horton works on projects for both single-family homes and multi-family apartment complexes.

DR Horton has been building homes for 45 years, and has closed over a million construction contracts in that time. The company has a portfolio of designs, showcasing homes in all price categories, from under $200,000 to over $1 million, and can even implement smart home technology from the ground up during construction.

While the company is a leader in its industry, it has felt the effects of headwinds in the real estate sector. Earnings have been down year-over-year over the past several quarters, even as revenue showed year-over-year gains. This pattern continued in recently reported results for the third quarter of fiscal 2023. DHI net profit was $9.7 billion, up 11% from the year-ago quarter, but non-GAAP net earnings per share of 3.90 Dollars was much lower than the third quarter figure of 22. $4.67. However, among investors’ larger takeaways, DHI beat expectations in both top and bottom earnings in the third quarter, with revenue coming in at $1.31 billion above expectations and earnings per share beating $1.07 per share.

Looking ahead, DHI reports two important metrics that bode well for future business. First, it closed 22,985 homes in the third quarter, up 8% year-over-year, and the total value of those homes closings increased 4% year-over-year, to $8.7 billion. The company’s net sales orders also rose 37% year-over-year to 22,879 homes. The total value of net sales orders was reported at $8.7 billion, up 26% year-over-year. As such, the company has raised its revenue forecast for the year, with the top end now expected to be in the $34.7 billion to $35.1 billion range compared to $31.5 to $33 billion previously. Consensus was $32.34 billion.

As for Warren Buffett, his company opened a new DHI position during the calendar second quarter. Berkshire Hathaway disclosed purchases of a total of 5,969,714 shares of DHI, a major stock acquisition now worth approximately $700 million.

Turning to Raymond James’ view, we find that analyst Buck Horn is impressed with Dr. Horton’s prospects for the next few quarters. He writes, “As it stands, we now see DHI on a path toward double-digit EPS growth and 20%+ ROIC metrics in FY24, most notably buoyed by our growing rental housing platform – which we believe will significantly mitigate the cyclicality associated with foreclosure rates.” With its original balance sheet primed for growth and acquisition opportunities, we believe DHI’s earnings visibility and profitability have improved to the point that investors should not be intimidated by current valuations.”

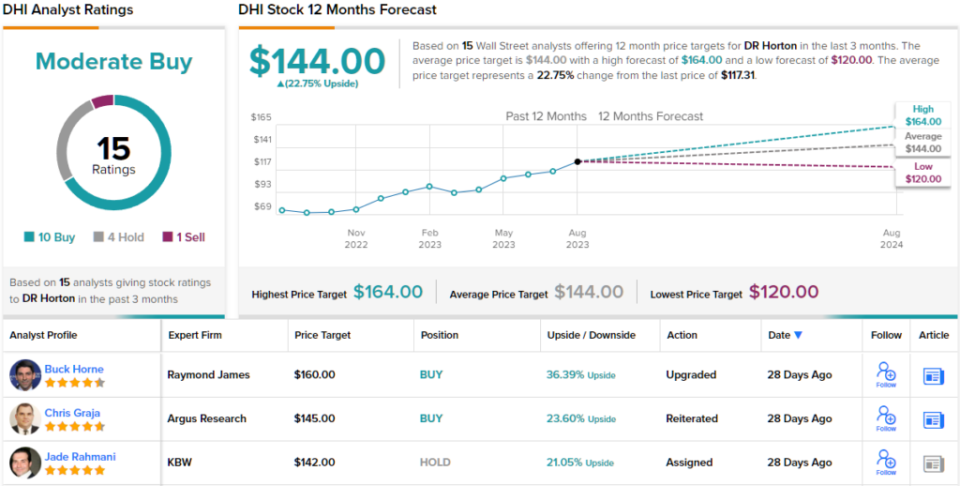

Along with these comments, Home gives DHI shares an outperform (i.e. Buy) rating, with a price target of $160 indicating a one-year upside potential of approximately 36%. (To see the homepage’s track record, click here)

Overall, DHI captured 15 recent Wall Street analyst ratings, and they include 10 Buy, 4 Hold, and 1 Sell to give the stock a Moderate Buy consensus rating. Shares are selling for $117.31, and an average price target of $144 means an upside of roughly 23% in the one-year horizon. (be seen DHI stock forecast)

Linnar Corporation (flexible)

Buffett’s next option we’re looking at is Florida-based Lennar Corp., another major US homebuilder. Lennar operates on the East Coast and Southeast, in the Great Lakes region, in Texas and Oklahoma, and in the West and West Coast regions. The company is consistently among the top 5 homebuilders in the country, by total home sales. Since its founding in 1954, Lennar has built more than 1 million homes.

The company controls a number of brands that provide services in all aspects of the new home industry. Five brands are in the business of construction, while Lennar Mortgage, Lennar Title and Lennar Insurance Agency provide the financial services needed to make homes available to buyers. Lennar has a long history of expanding its operations through acquisition, and currently operates in 26 states.

In 2022, Lennar reported more than $33 billion in total revenue, but the company isn’t on track yet this year to meet that number. In its Q2 ’23 report, Lennar showed a top line of $8.05 billion, down 3.7% year-over-year, although it should be noted that that’s about $810 million higher than estimates. The company’s second-quarter earnings, of $2.94 by GAAP standards, also beat expectations — by 62 cents per share.

Lennar delivered 17,074 homes in the second quarter, and it finished the quarter with new orders for 17,885 homes — a total value of $8.2 billion. The company’s backlog, an important metric for future business, is reported at 20,214 homes worth $9.5 billion.

Mirroring a new position for Buffett’s Berkshire Hathaway, the company pulled the trigger on 152,572 shares in the second quarter. This stake in Lennar is currently valued at $17.85 million.

He was also bullish on the stock, as Raymond James Buckhorn was impressed with Lennar’s ability to sustain production.

“By combining targeted price reductions with incentives and mortgage rate purchases to keep home production flowing, despite mortgage rate volatility, Lennar has been able to identify the noticeable reservoir of pent-up housing demand much sooner than most… we find shares LEN trades at 1.7 times late book value and 9.5 times earnings per share for FY24, roughly in line with peer averages.As such, we believe LEN shares still deserve a material revaluation thanks to an expected ROIC of 15%+, double-digit EPS growth, and net debt-free balance sheet,” Horn said.

In gauging his stance, Horn continues to outperform LEN (i.e. Buy), and sets a price target of $150 per share to show his confidence in a 28% gain over a 12-month horizon.

Overall, Lennar captured 16 recent analyst ratings and includes 10 Buys, 4 Holds, and 2 Sells to give the stock a Moderate Buy consensus rating. The average price target of $134.40 and the current trading price of $117 together suggest approximately 15% upside potential for one year. (be seen Lennar stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best stocks to buya newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.