Happy chatter from Washington, consistently low unemployment, and slowing inflation have all combined to support positive market sentiment – but can this last? Shark Tank star Kevin O’Leary thinks it won’t, and doesn’t hesitate to list the headwinds that could bring “real chaos” by the end of the year.

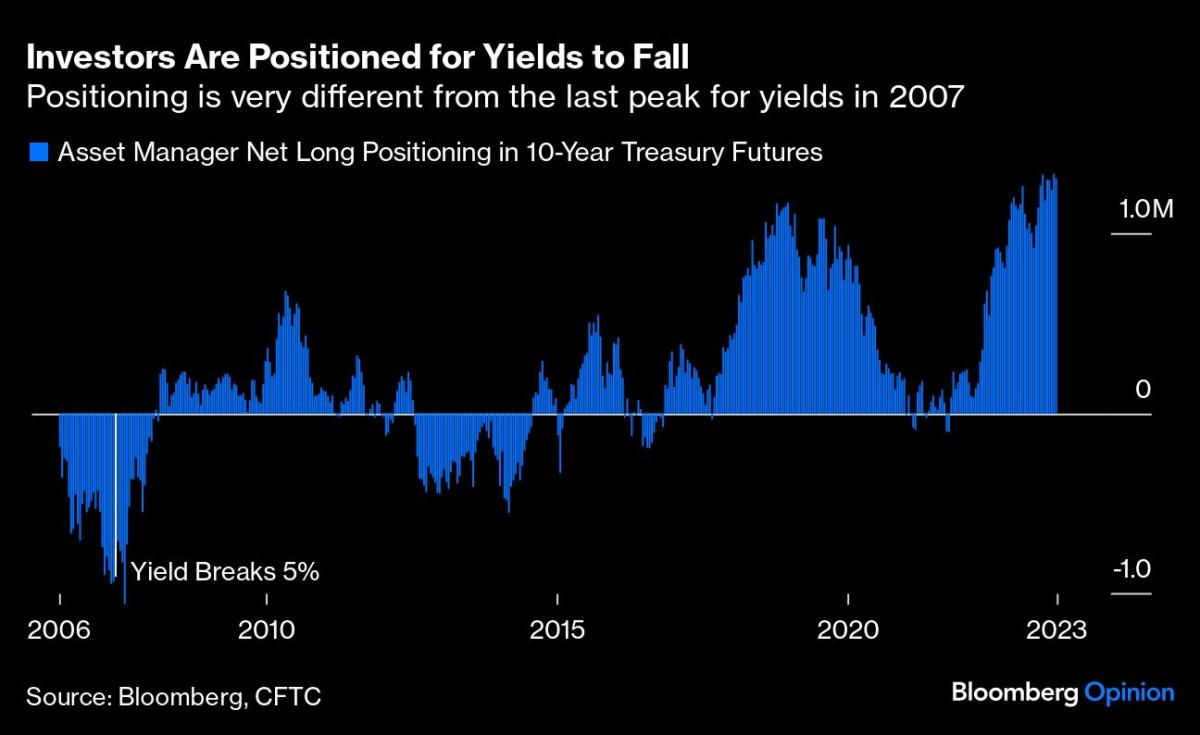

The main factor is high interest rates. The Fed has already raised interest rates to their highest level in over 20 years, and the fallout is rippling. O’Leary takes particular care to point out the effects on the commercial real estate market, where rising rates mean that commercial mortgages – $1.5 trillion of which is due to be delivered in the next few years – will be refinanced at nearly twice their current value. interest rate.

With more than $64 billion in distressed commercial real estate assets, O’Leary also notes that commercial mortgage delinquencies reached 3% by the end of Q1 2020. In addition, small businesses, which make up about 60%, are struggling. From the US labor market, from the lack of liquidity and credit, as banks and other financial institutions tighten lending conditions.

All of these factors add up to a situation that calls for a defensive stance; Investors will need to find protection for their investment portfolios. Logical action – and classic defensive play – is a turn on Dividend shares. These stocks, with their combination of passive income and low average volatility, provide a shield against potential downturns.

Wall Street analysts have described two dividend-paying stocks as compelling “strong buys” with promising prospects. Let’s take a closer look.

Brookfield Renewable Energy Partners (best environmental practices)

The first dividend stock we’ll look at is Brookfield Renewable Partners. Headquartered in Bermuda, the company has a global footprint of diversified energy assets. Its portfolio includes a wide range of distributed energy and sustainable operations. In addition, it features more traditional green energy projects, such as wind, solar and hydroelectric power generation systems.

The name “Brookfield” should be familiar. One of Canada’s largest alternative investment firms, Brookfield Asset Management owns a 60% stake in Brookfield Renewable Partners. This provides a strong financial backbone for the energy company, allowing it to expand its power generation facilities and operate on utility scales.

Earlier this month, BEP released its financial results for the second quarter of 2023. Notably, the company saw a 6.1% year-over-year growth in its funds from operations (FFO). Specifically, FFO increased from $294 million in the year-ago quarter to $312 million in the second quarter of ’23. Per share, FFO was 48 cents, which is 2 cents higher than it was in the year-ago quarter. FFO is subsidizing the dividend here, which was 33.75 cents per common share.

Moving on to the dividend, we find that BEP has an annual rate of $1.35 per share and a yield of 5.1%. The dividend has been maintained without losing a quarter since 2018.

For Wells Fargo analyst Jonathan Reeder, the story of BEP is about benefiting from decarbonisation. The analyst believes that BEP has positioned itself to survive the downturn.

“We continue to look at BEP/BEPC as a compelling way for investors to play in the global decarbonization movement. Brookfield has the ability to deploy capital – at scale – in traditional renewable assets as well as more strategic investments in companies that are capitalizing on trends (such as Westinghouse and Origin) “We believe BEP’s conservative strategy (IG’s balance sheet, inflation-related revenue, etc.) is built on taking on macro challenges,” Reeder said.

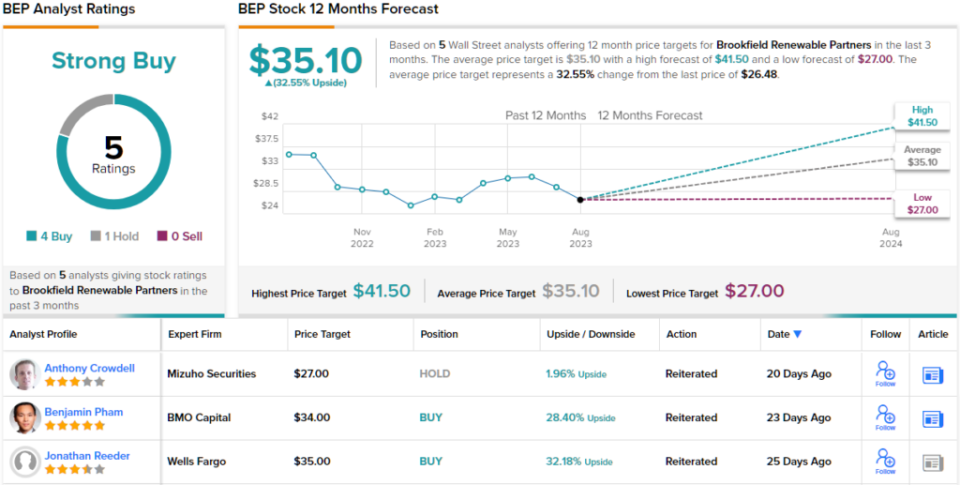

To this end, Reeder rates the BEP as Overweight (ie Buy), while its $35 price target implies a 32% upside heading to a one-year horizon. (To view Reader’s track record, click here)

Most of fellow Wells Fargo analysts are on the same page. Based on 4 Buys and 1 Hold, BEP has a Strong Buy consensus rating. At $35.10, the average price target could provide investors with an upside of about 23% in the coming months. (be seen BEP stock forecast)

Diamondback energy (fang)

Next up is Diamondback Energy, an independent oil and natural gas exploration and production company headquartered in Texas. Diamondback is focused on unconventional onshore operations in both oil and natural gas, engaging in activities such as the acquisition, development, exploration and exploitation of these energy resources, particularly in the Permian Basin in West Texas. Diamondback uses a horizontal exploitation strategy to maximize the value extracted from each well.

The Permian Basin, where Diamondback focuses its efforts, is the largest oil-producing sedimentary basin in the United States. Over the past two decades, its high production has put Texas back on the world oil producer map. In the second quarter of this year, Diamondback achieved an average daily production of 449,912 barrels of oil equivalent, representing an increase of 5.8% over the previous quarter and an increase of 18% year-on-year.

Despite the growth in Diamondback’s overall production numbers, the company has seen both revenue and earnings decline year-over-year. Revenue totaled $1.92 billion, which was a decrease of nearly 30% compared to the previous year. Similarly, the adjusted earnings per share number of $3.68 per share was down from more than $7 in the corresponding period a year earlier. However, second-quarter revenue and earnings-per-share numbers beat analysts’ expectations, beating forecasts by $26.19 million and 21 cents per share, respectively.

During the second quarter, Diamondback generated free cash flow of $547 million. The figure should interest dividend investors because it directly supports the company’s capital return policy, which includes dividend payments and share buybacks. In the second quarter, Diamondback set aside $473 million for these purposes. The last dividend for the second quarter was paid on August 17, at 84 cents per share. Annually, this translates to $3.36 per share and yields 2.2%. The company has a history of adjusting dividend amounts to ensure coverage and has paid dividends consistently since 2018 without missing a single quarter.

For 5-star analyst at RBC Capital, Scott Hanold, the reliability of this company is the point for investors to consider. He writes of Diamondback, “Focus on stable operations yields consistent results that slightly beat expectations. This supports its strong outlook for FCF which has provided confidence to increase steady earnings. Additional shareholder returns remain a decision based on FANG’s intrinsic value that can be traced back to a more diversified dividend.” We see good bullish value in FANG shares in the current market, which generally warrants buybacks, but at mid-cycle oil prices, the valuation is likely to be near the upper end of the range.

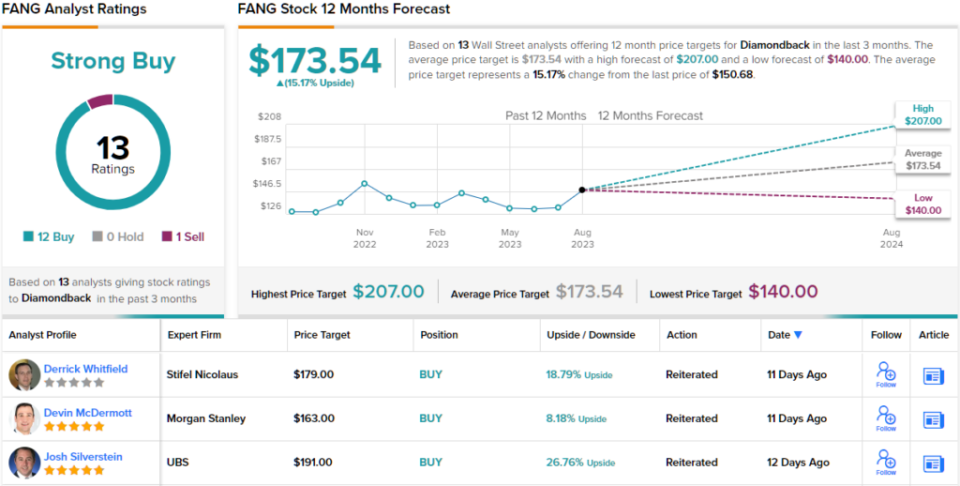

Hannold continues to give FANG shares an outperform (i.e. Buy) rating, while his $170 price target suggests the stock is up about 13% in the next year. (To watch Hanold’s track record, click here)

Overall, 11 other analysts join Hanold in the bullish camp, and not a single drop can add to detract from the Strong Buy consensus rating. Forecasts are for 12-month returns of 15%, with an average target of $173.53. (be seen Diamondback stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks Best stocks to buya tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.