Have you ever wondered where the rich stash their money? It’s a question that baffles many, and its answer may surprise you.

A recent study by the private Bank of America sheds light on the financial habits of millionaires in the United States. It turns out that the richest Americans, especially those between the ages of 21 and 42 with at least $3 million in investable assets, take a different approach to wealth management than their older counterparts.

according to the surveyThese young millionaires hold only 25% of their assets in stocks or equity funds. In contrast, wealthy investors age 43 or older allocate an average of 55% of their assets to equities.

do not miss:

The old adage “don’t put all your eggs in one basket” has never been more relevant than it is today. Wealthy millennials have learned this lesson, and it is reflected in their investment choices. So where do the rich really store their wealth? Below is a variety of financial and real assets favored by high net worth individuals.

1. Cash and cash equivalents: the safety net of the wealthy

Thrift is a common trait among many millionaires. While they enjoy some luxuries, they also save diligently. Before diving into investments, they create large emergency funds. In a world where time is money, many millionaires keep a large portion of their wealth in cash or a highly liquid cash equivalent.

Studies show that, on average, millionaires may own the equivalent 25% of their wealth cash Money. This prudent approach helps them offset potential market downturns and acts as a safety net for their investment portfolios. Cash equivalents, which are highly liquid financial instruments, are also preferred. Examples include money market mutual funds, certificates of deposit, commercial paper, and treasury bills.

Some millionaires invest strategically in Treasury securities, continually rolling them over and reinvesting the proceeds. Treasury bonds are short-term securities issued by the United States government to raise funds, and are often bought at a discount. When selling, the difference between the nominal value and the selling price becomes a profit. This strategy is favored by financial expert Warren Buffett, CEO of Berkshire Hathaway.

Goldman Sachs says: Portfolio(s) that contain a tranche of real assets (like art) performed better than 60/40 in the long run.

2. Real assets: tangible wealth

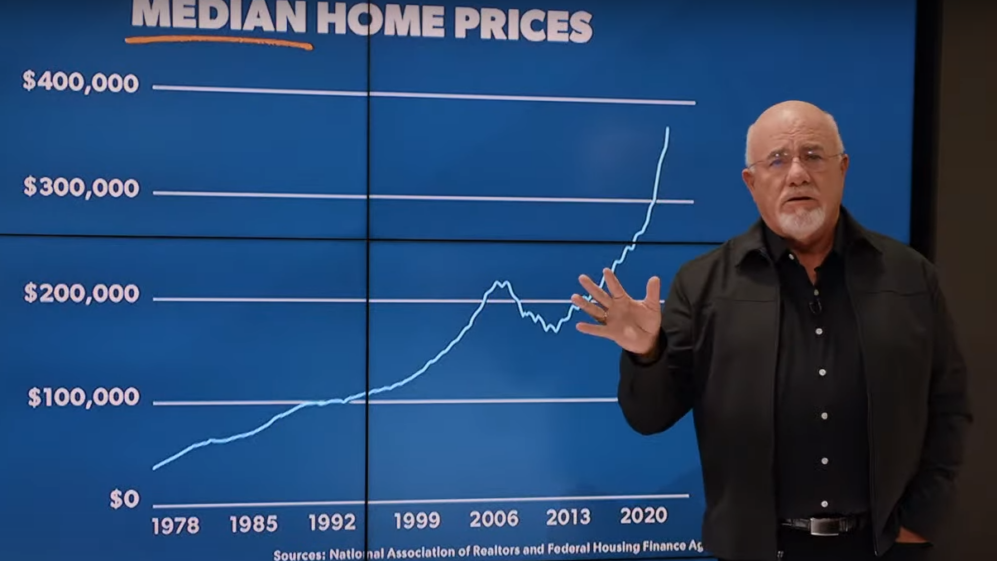

For the wealthy, diversification goes beyond stocks and bonds. Real estate holds a special place in their investment portfolios. This asset class includes residential real estate, commercial real estate, vacation rentals, and real estate investment trusts (REITs). The attraction lies in how realistic these investments are and the potential for rental income.

3. Luxury Collectibles and Assets: Where passion meets profit

Away from traditional investments, many millionaires diversify by indulging their passions. They invest in rare art, vintage cars, and other collectibles. Not only do these items have the potential to appreciate greatly in value, but they also bring happiness through ownership.

One avenue that has gained a lot of attention in recent years is investing in the fine arts through platforms such as masterpieces. This new approach allows art lovers and investors alike to own equity in valuable works of art, often created by world-renowned artists. The attraction lies in the potential for aesthetic enjoyment and financial gain.

Masterworks has opened the door for investors to participate in the art market, which has historically been reserved for the elite. By purchasing shares in highly valued works of art, investors can benefit from the appreciation of art over time. This democracy in artistic investment has aroused the interest of many wealthy people who seek to diversify their investment portfolios while indulging their passion for art.

4. Entrepreneurship: Wealth Generator

more than two-thirds Among all millionaires are entrepreneurs. They built their fortunes through innovation and hard work, not just inheritance. This entrepreneurial spirit often leads them to invest in their own businesses or in promising start-ups, either directly or through private equity funds.

5. Startups and Private Equity: Nurturing innovation for financial growth

Many young millionaires invest directly in startup companies or through private equity funds. This approach allows them to support innovation and reap significant returns if the startup becomes highly successful. These investments also provide a sense of involvement and influence over the companies they support.

Whether you are a millionaire or not, understanding these strategies can provide valuable insights into sound financial management. A trusted financial advisor can help people at all income levels take important steps toward achieving their financial goals, just as private bankers help the truly wealthy navigate the complex world of finance.

Read on:

Don’t miss out on real-time alerts on your stocks – join Benzinga Pro Free! Try the tool that will help you invest smarter, faster and better.

This article Young millionaires don’t put all their eggs in one basket – here’s what they invest in for explosive growth originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.