We have a new total interest rate leader today — a newly unveiled 6-month jumbo CD paying 5.85% APY. If you can’t manage a $100,000 deposit, today also brings you a new option to earn CD’s record high rate of 5.75% APY.

The new Jumbo Leader is offered by One American Bank for a period of 170 days. Among standard CDs, the leading 5.75% rate is still available from MapleMark Bank For 12 months, but now also from Credit union abound for 10 months.

main sockets

- The CD’s highest nationwide rate is now 5.85%, but it’s only available as a jumbo certificate with a $100,000 deposit.

- For smaller deposits, the leading overall rate in our daily ranking of top CDs nationwide is 5.75%, with a second option joining the ranks today at that rate.

- Our number of ‘normative leaders’ – those offering 5.50% or more – is up to 29, from 28 yesterday and just 15 at the start of August.

- The longest you can earn at least 5.00% remains three years at a rate of 5.13% APY, or four years at a rate of 5.12% APY if you can deposit at least $100,000.

- The Fed will not meet again on rates until mid-September, and it is not certain whether it will raise interest rates again higher, or keep them steady.

To help you earn as much as possible, here are the best CD prices available from our partners, followed by more information about the most profitable CDs available to US customers everywhere.

For anyone who wants one of today’s standard rates for a term of more than 2 years, you can get 5.13% APY from the credit union’s top ranking 3-year CD, or 5.00% from one of the three banks’ CDs in that range. Or if you can manage a minimum deposit of $100,000, you can extend your term to four years with a jumbo APY certificate of 5.12%.

CD Shopper Tip

Do you think you need to hold on to a bank CD because joining a credit union is too much of a hassle? Think again. The credit unions that we include in our rankings are open to anyone nationwide and easy to join. Although some require a donation to an affiliated nonprofit organization, the amount required is generally modest, and some require no donation or cost at all. The process for opening an account with a credit union is also the same as opening an account with a new bank.

Be careful

Although it is suggested that a larger deposit entitles you to a higher payout, this is not always the case for hefty certificate rates, which often pay less than standard CDs. Although today’s best jumbo deals, which typically require a deposit of $100,000 or more, beat the standard best rates in six CD terms, you can do as well or better in the other two quarters with a standard CD. So always make sure to shop around each certificate type before making a final decision.

Will CD Prices Increase in 2023?

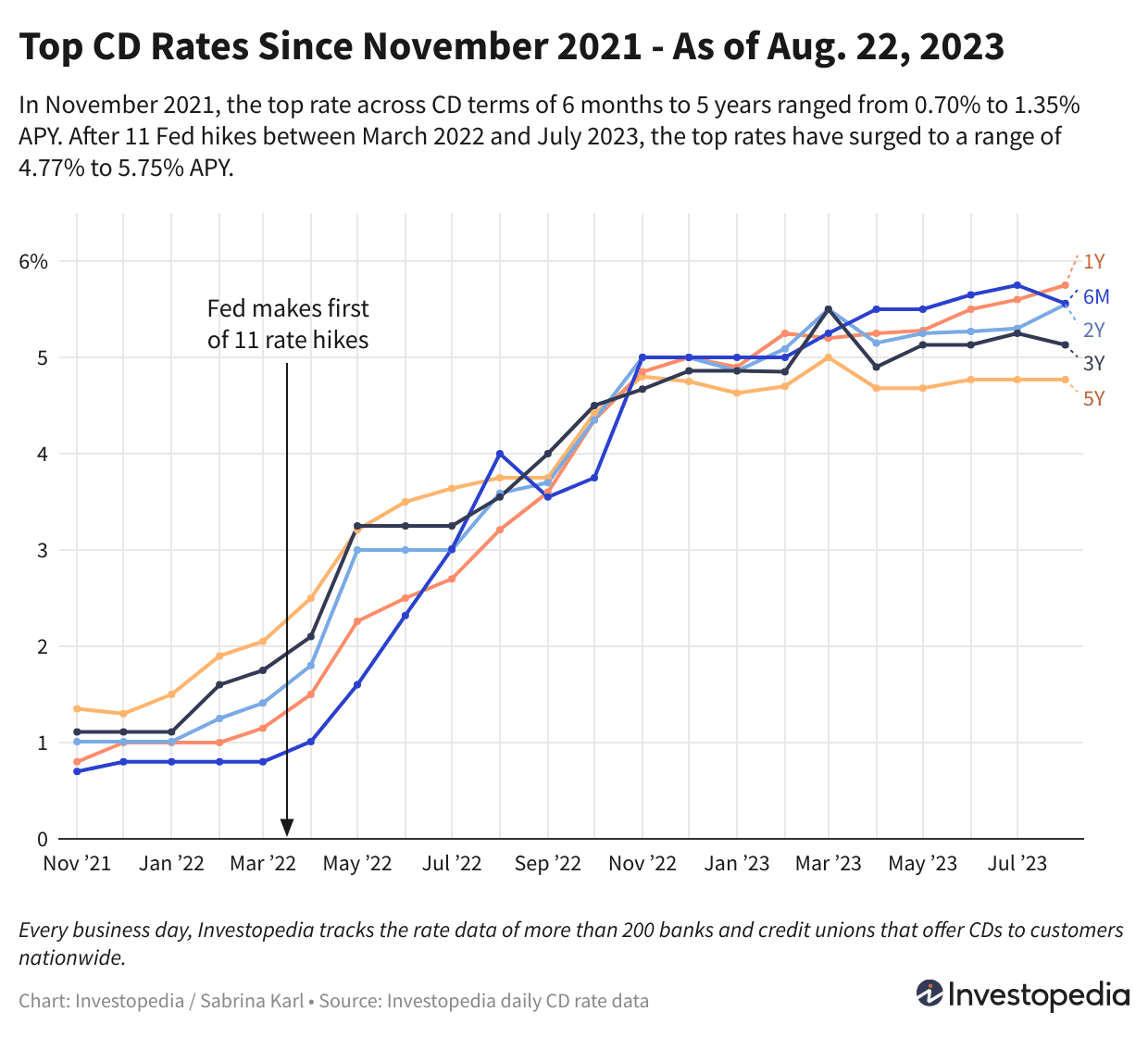

This year has already seen CD rates hit record highs, but it could go even higher. That’s because the Federal Reserve has left the door open for further increases in the federal funds rate, which is severely affecting certificates of deposit rates.

The Fed raised the federal funds rate by 0.25% at its July 26 meeting, and won’t meet again until September 20. Federal Reserve Chairman Jerome Powell could provide more clues regarding the path of monetary policy at the Jackson Hole Economic Symposium later this week. Where he is scheduled to speak Friday.

The Fed has been aggressively battling decades-high inflation since March last year, with 11 increases to its record rate over the past 12 meetings. The July high brought the cumulative increase to 5.25%, pushing the federal funds rate to its highest level since 2001. This has created historic conditions for CD shoppers, as well as for anyone with cash in a high-yield savings account or in the money market.

The Fed’s official announcement in July did not provide any strong indications as to whether it would raise the benchmark interest rate higher this year. The written statement simply reiterated the Fed’s commitment to lower inflation to its target of 2%.

In his post-announcement press conference, Chairman Powell noted that the rate-setting committee had not yet made any decisions about raising rates again in 2023 — or if so, what the timing or speed of any increases would follow. He specifically mentioned that rising and stopping were both possibilities at the next meeting, scheduled for September 19-20.

Since then, various Fed governors have made public remarks about their expectations of whether the committee will raise or suspend interest rates in the future. Earlier this month, two emphasized the need to keep an eye on upcoming data and decide on a meeting cycle-by-meeting – including the possibility of another hike – while a third noted that unless something unexpected appears in the data, he expects rates to be held. without any other increases.

A fourth member of the committee spoke last week and noted that although the central bank could take some time to let in more data, it is not ready to announce the end of rate hikes by the Fed. He also indicated that it would be 2024 or even 2025 before the Fed moves the other way and lowers interest rates.

The rate hike in July is likely to push CD rates higher. But the impact is also likely to start to wear off as banks and credit unions wait for a clearer picture of the Fed’s next move. In any case, once the Fed appears ready to end its rate hike campaign for good, that would indicate that CD rates are likely to have peaked.

Note that the “higher rates” listed here are the highest rates available nationwide that Investopedia has determined in its daily rate search on hundreds of banks and credit unions. This is very different from the national average, which includes all banks that offer a CD with that term, including many of the larger ones that pay minuscule interest. Thus, national rates are always very low, while higher rates that you can find out by shopping around are often five, 10 or even 15 times higher.

Disclosure of the price collection methodology

Every business day, Investopedia tracks pricing data for more than 200 banks and credit unions that offer CDs to customers across the country and determines daily ratings for the highest-paying certificates in each key term. To qualify for our listings, an organization must be federally insured (FDIC for banks, NCUA for credit unions), and the minimum initial CD deposit must not exceed $25,000.

Banks must be available in at least 40 states. And although some credit unions require you to make a donation to a specific charity or association to become a member if you don’t meet other eligibility criteria (for example, you don’t live in a certain area or work in a certain type of job), we exclude credit unions whose donation requirements are $40 or more. For more information on how to choose the best rates, read our full methodology.