-

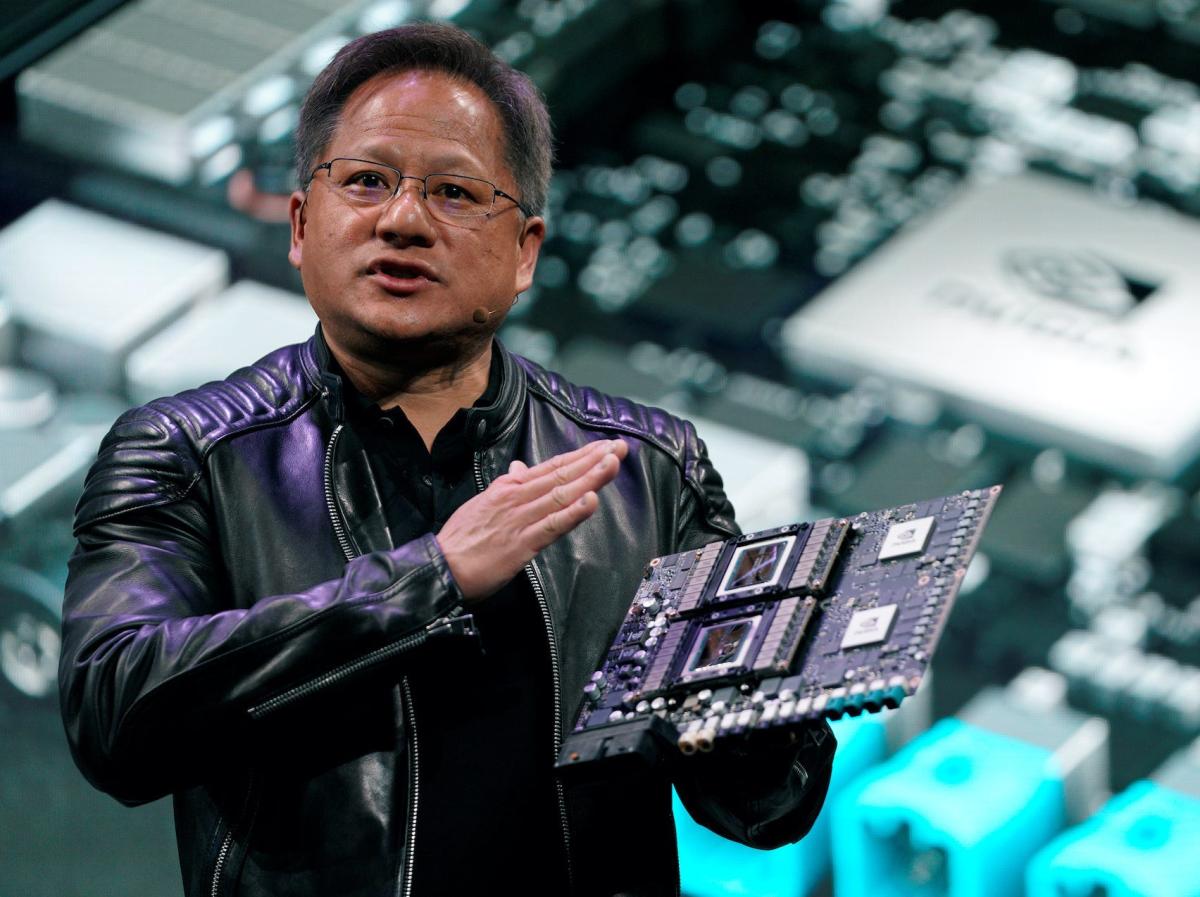

Investors await Nvidia’s second-quarter earnings report after the market closes on Wednesday.

-

The artificial intelligence chip company set expectations high after revenue guidance for May beat Wall Street estimates.

-

Here’s what Wall Street expects from Nvidia’s upcoming earnings report.

nvidia Investors will be watching closely this week as the company prepares to release its earnings report for the second quarter after the market closes on Wednesday.

The chip maker blew up analyst expectations in May when issued second-quarter revenue guidance of $11 billion, Which beat Wall Street estimates by a whopping $4 billion.

The company, which manufactures and sells graphics processing units (GPUs) that help power AI chatbots like ChatGPT, has seen demand for its products skyrocket over the past few months, and is firmly in the lead in the AI chip market.

“We use a lot nvidia hardware. We’ll actually take it as fast as you hand it over to us. Honestly, if they can give us enough GPUs, we might not need Dojo. But they can’t. They have a lot of customers,” Tesla CEO Elon Musk said He said during Tesla’s second quarter earnings call in July.

The boom has been in Nvidia’s AI-focused business It caused its share price to rise More than 200% year-to-date, giving it a market valuation of $1.1 trillion.

Most of Wall Street expects Nvidia to continue to impress investors with strong second-quarter results, and better-than-expected guidance for the second half of the year. The median estimate for EPS for the quarter is $2.07, and the median estimate for revenue is $11.2 billion, according to data from YahooFinance.

Here’s what Wall Street analysts have to say about Nvidia’s upcoming earnings report.

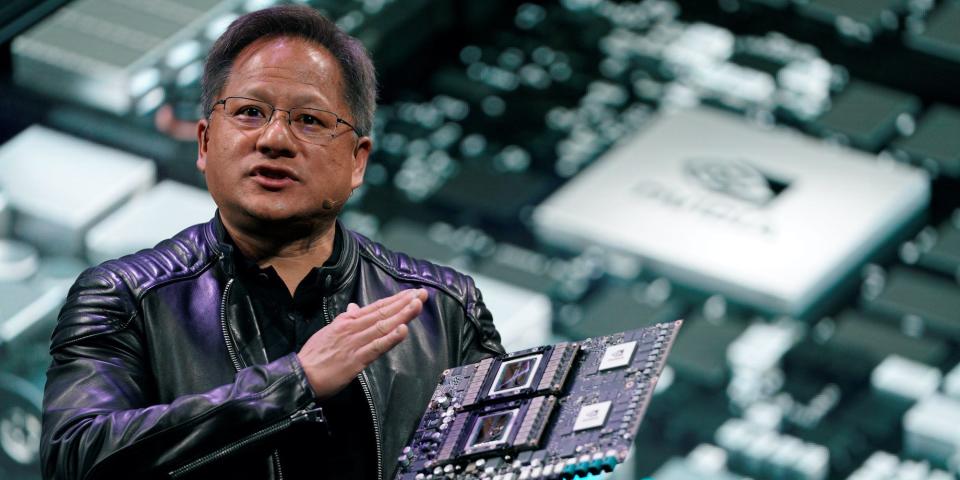

Barclays: “Nvidia remains our preferred exposure to AI.”

“Back checks in Asia show Nvidia backend could support up to $15 billion in H100/A100 revenue in the third quarter and more in the fourth quarter, leaving the potential for more cadences and big upsides through the quarters,” Barclays said in a note late last month. Next few,” referring to Nvidia’s GPUs

The data center consensus estimate (including Mellanox) for the third quarter is only $8.5 billion… AMD looks in the market as a potential first contender, but we likely won’t see even initial signs of success until next year. In the meantime, Nvidia will continue to gain gets the lion’s share of the economy from the AI boom.”

Barclays rates Nvidia “overweight” with a $600 price target.

Bank of America: “From Shock and Awe to Consolidation and Progress.”

Nvidia is a “top pick in the sector ahead of the F2Q earnings call due to its dominant position and multi-year runway in converting $1+ trillion in traditional global data centers to AI/Agile Computing.” Following last quarter’s shock-and-awe report, we expect sentiment to be more measured A little bit bigger. Demand is not the issue, it’s supply (packaging, memory) and more importantly the speed at which US cloud providers can set up genAI compute instances,” American bank he said in a note earlier this month.

Nvidia is unlikely to guide more than quarterly, but listen to management’s comments about continued sales acceleration/early descent etc. Post-earnings reaction could see some near-term stock consolidation after 200%+ rally YTD (against SOX up 46%),” BofA said.

Bank of America rates Nvidia at “Buy” with a price target of $550.

Goldman Sachs: “An Important Lister for the Future.”

“We continue to see a significant runway ahead for the company based on its strong competitive position in the fast-growing (yet emerging) AI semiconductor market. With our forward-looking estimates outperforming Street consensus, we envision positive EPS reviews supporting continued outperformance of share prices through what remains of the calendar year,” Goldman Sachs he said in a note last month.

Goldman Sachs rates Nvidia at “Buy” with a price target of $495.

Read the original article at Business interested